Financial news can feel overwhelming. Central banks implementing monetary policy, GDP and growth forecasts, inflation reports – but how does this all connect to investing? In this series, I will be building my own investment portfolio from scratch, walking you through each step of my decision making process. Each post in this series will cover a different part of my thought process using this strategy, until I have a final product I can provide progress updates on.

Using a Top-Down Strategy

For this investment portfolio I will be using a top-down strategy. This is an approach where I will start by looking at the global economy rather than individual companies. The idea is that macro factors (i.e. inflation, interest rates, geopolitics) shape how all markets perform. By researching and understanding these first, I can narrow my focus onto specific regions, sectors, and microeconomic factors to aid my decision making when selecting where to invest. In this first stage of my top-down approach, I’ve analysed the latest IMF, World Bank, and OECD outlooks to understand macroeconomic trends and how it may shape my investment decisions.

Global Outlook

After several years of volatility driven by inflation shocks and policy shifts, the global economy seems to be catching its breath. Growth is stabilising and inflationary pressures easing as central banks cautiously transition into a period of quantitative easing. Global growth is projected at 3.0% for 2025 (0.2 percentage points higher than the forecast in April), while global headline inflation is expected to fall to 4.2%. Growth in advanced economies are expected to be at 1.5% and 1.6% respectively for 2025 and 2026, with fiscal stimulus measures expected to be introduced in the near term for major economies such as Germany.

However cross country differences are present; inflation in the United States is expected to remain above target, while in other large economies inflation is expected to be more subdued. Monetary policy rates are also diverging: UK and US have begun cutting rates in this second half of 2025, whereas other regions like the Euro area are expected to keep rates the same.

Regional Projections

As mentioned previously, the global outlook suggests steady growth, however each region faces a different set of challenges and opportunities shaped by fiscal choices, trade tensions, and the lingering effects of inflation.

In the US, policy uncertainty combined with higher tariff rates and the subsequent retaliatory measures means output growth is expected to slow significantly. Growth is expected to slow from 2.8% in 2024 to 1.6% and 1.5% in 2025 and 2026 respectively, with core inflation expected to peak at 4% in the fourth quarter of 2025 and remain above target through 2026. However, the US economy can be projected to expand at a rate of 1.9% and 2.0% in 2025 and 2026 respectively given tariff rates settle at lower levels and there is an implementation of looser fiscal policy.

The US Dollar’s recent weakening has prompted investors to move away from US securities, opening opportunities in emerging markets where currencies have appreciated. However, many emerging markets will face softer export growth due to lower demand from the US. India remains an outlier, as Indian Rupee is facing challenges in valuation due to trade tensions with the US, however, India has also been projected a strong and stable growth of 6.4% in 2025.

Growth in the Euro area is set to remain modest as trade frictions are offset by capital spending from Next Generation EU funds and resilient labour markets. As headline inflation is expected to return to the target level in 2026, price pressures can be expected to decrease. Politically, France continue to face instability as their Prime Minister resigned after just a few weeks in office. Meanwhile Germany’s planned increase in defence and infrastructure spending is expected to result in a large stimulus in 2026 and attract public investment. However, the EU’s high exposure to adverse shifts in trade policies make recent tariff negotiations with the US and trade within the region crucial for growth and stability.

Tariffs, Trade, and Geopolitical Tensions

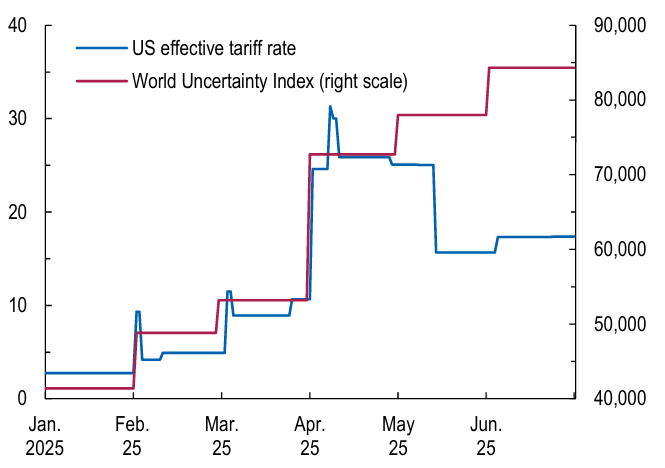

A major disruptor in the global economy this year has been Donald Trump’s tariffs. The trade restrictions placed by the US have been unprecedented, unsettling global financial markets and weakening consumer confidence, with the US effective tariff rate reaching its highest level since the 1930s.

Beyond the massive disruption to global trade, the unpredictability of US trade policy has been a key issue. Countries have scrambled to construct deals with the US to avoid tariff rates that have been threatened as high as 50% on Euro area goods. This almost erratic policy environment has increased trade policy uncertainty tremendously, and while recent agreements improve the short term outlook, the risk of future volatility remains high.

The uncertainty itself has acted as a drag on short term investments and has created a trend of protectionism where domestic focused policies are likely to hinder cross border flows of commerce, capital, and technology in the long term. Rapid policy shifts have posed a challenge for firms to plan ahead, leading to reduced capital investment and hiring plans, and aggressive front loading from US firms ahead of higher prices caused by tariffs (front loading is where a firm may accelerate the importation of goods in anticipation of trade disruption – can lead to cash flow strain and includes an element of risk when forecasting future demand).

Trade tensions appear to be stabling somewhat and potential for resolutions could bring comfort in the short term. Resolutions could lead to a reduction in effective tariff rates, easing upward pressure on consumer prices, raising profits for importing and exporting firms, and increasing consumer confidence which in turn could partially offset the widespread drag on investment. This could have disinflationary impacts in the US and countries rolling back on retaliatory measures and could lift global growth.

However, if uncertainty persists, export intensive industries may experience adverse impacts on output and employment, developing economies may experience weakened investment and firms leaving their country due to tariff restrictions, and larger economies could face challenges in their attempts to overcome current domestic hurdles.

While uncertainty is expected to decline as trade patterns adjust, uncertainty isn’t completely eradicated. Therefore, for my investment strategy, I will have to focus on how the tariffs have affected specific countries and sectors that I look to invest in, especially those exposed to trade risk.

Commodities

Trade barriers and policy uncertainty have been a driving factor for falls in commodity prices since February as they have caused weaker growth prospects. Annual average commodity prices are expected to decline by 10% this year and a further 6% in 2026, as its predicted that energy and metals expand and there will be an easing of agricultural supply constraints. Tensions on demand for oil and rapid increases in oil production saw prices decline in early April, with projections at $66 and $61 a barrel respectively in 2025 and 2026 for Brent oil prices.

Supply shocks to coffee and cocoa have caused a surge in beverage prices, however it has been offset by a decline in food prices as there are mounting rice stocks and record high soybean production this year. The metal index is projected to drop by 5% this year before recovering in late 2026 due to trade tensions. While prices for base metals are set to drop this year, the precious metal index is set to increase by more than 30% as Gold is set to reach record high prices, plateauing in 2026-27.

Investment Implications

Understanding how tariffs impact regional growth and investor sentiment will be key in identifying vulnerabilities and opportunities for my top-down analysis. Based on these insights, my initial portfolio approach will lean towards markets supported by fiscal expansion and resilient domestic consumption, possibly looking into the Euro area at countries such as Germany where fiscal stimulus could drive growth.

I will also look to incorporate assets such as gold and high quality bonds to balance out the uncertainty surround trade and inflation trajectories. I will approach the US equity market with caution, however, I also understand there may be potential opportunities while inflation continues to ease and trade relations improve (hopefully!). There are also opportunities to capitalise on emerging markets that have high projected growth despite global uncertainty, such as India, although I will monitor their evolving relations with the US.

As I continue this series, this global framework will serve as the backbone for me to decide asset allocations and track how real world data influences performance over time. In this unpredictable environment, diversification remains essential. I need to balance my investments across regions and asset classes to mitigate risk. I’ll expand on this in my next post as I explore specific countries, sectors, and industries I plan to target.

References

International Monetary Fund. (2025). World Economic Outlook Update, July 2025: Global Economy: Tenuous Resilience amid Persistent Uncertainty. Available at: https://www.imf.org/en/Publications/WEO .

World Bank Group. (2025). Global Economic Prospects: June 2025. Available at: https://openknowledge.worldbank.org/server/api/core/bitstreams/0e685254-776a-40cf-b0ac-f329dd182e9b/content

OECD. (2025). OECD Economic Outlook: Volume 2025 Issue 1: Tackling Uncertainty, Reviving Growth. Paris: OECD Publishing. Available at: https://www.oecd.org/en/publications/oecd-economic-outlook-volume-2025-issue-1_83363382-en.html

FT Reporters. (2025). Trump Tracker: US Tariffs. Financial Times. Available at: https://www.ft.com/content/2c473393-35fb-479d-8bba-236a1a98087c

Leave a comment